Learn how to Buy Safaricom Shares in Kenya easily. Discover the requirements, step-by-step process, costs, and tips to invest in Safaricom stock and grow your wealth through the Nairobi Securities Exchange (NSE).

Table of Contents

Introduction

Safaricom PLC is not just Kenya’s largest telecommunications company — it’s also one of the most profitable and trusted brands in East Africa. For many investors, owning Safaricom shares represents a stake in Kenya’s digital future.

If you’ve ever wanted to know how to buy Safaricom shares in Kenya, this detailed guide walks you through everything — from opening a CDS account to tracking your investment performance. Whether you’re a beginner investor or an experienced trader, this step-by-step guide will help you get started confidently.

1. Why Invest in Safaricom Shares?

Before you begin, it’s important to understand why Safaricom is such an attractive investment for both local and foreign investors.

-

Strong Financial Performance – Safaricom consistently reports billions in profits annually, thanks to its wide customer base and innovative products like M-PESA, Fuliza, and Safaricom Home Fibre.

-

Regular Dividend Payments – Shareholders receive dividends almost every year, providing a steady income stream.

-

Market Stability – Safaricom is a blue-chip stock listed on the Nairobi Securities Exchange (NSE), making it relatively stable compared to smaller companies.

-

Growth Potential – With expansion into new services and technology partnerships, the company’s future growth prospects remain promising.

In short, Safaricom is a cornerstone of Kenya’s economy — and owning its shares gives you a chance to participate in that success.

2. Understand What You’re Buying

When you buy Safaricom shares, you are purchasing small ownership units in the company. This ownership entitles you to:

- Dividends – A share of the company’s profits distributed to shareholders.

- Capital Gains – Profit made if you sell your shares at a higher price than you bought them.

- Voting Rights – The right to vote on company decisions during the Annual General Meeting (AGM).

Safaricom’s shares trade under the ticker symbol SCOM on the Nairobi Securities Exchange (NSE).

3. Requirements for Buying Safaricom Shares

To buy Safaricom shares in Kenya, you must first meet the basic requirements below:

- National ID or Passport – Proof of identity for Kenyan citizens and foreign investors.

- KRA PIN Certificate – Required for all financial transactions in Kenya.

- Bank Account – To facilitate payment for shares and receive dividends.

- CDS Account – A Central Depository System (CDS) account is mandatory for buying and holding shares electronically.

4. How to Open a CDS Account

A CDS account is like a bank account, but instead of money, it holds your shares. You can open one through:

a) A Licensed Stockbroker or Investment Bank

Visit any NSE-licensed broker such as:

- Dyer & Blair Investment Bank

- Genghis Capital

- Faida Investment Bank

- NCBA Investment Bank

- Sterling Capital

They’ll guide you through the process, which usually involves filling out a form and submitting a copy of your ID, KRA PIN, and passport photo.

b) The Central Bank of Kenya (CBK)

You can also open a CDS account directly through the CBK if you plan to invest in government securities, though most investors prefer brokers for convenience.

Once your CDS account is active, you’ll receive a CDS number, which you’ll use to buy and sell shares on the NSE.

Related: How to Open a Shares CDS Account in Kenya

5. Funding Your Account

After opening your CDS account, you need to fund it before buying Safaricom shares. You can do this by depositing money into your broker’s client account via bank transfer or M-PESA paybill, depending on your broker’s payment options.

Ensure you confirm the broker’s details before transferring funds to avoid fraud.

6. How to Buy Safaricom Shares in Kenya

Here’s a step-by-step guide to purchasing Safaricom shares through your broker:

- Decide How Many Shares to Buy – Safaricom shares typically trade in lots of 100 shares minimum. Check the current share price on the NSE website or your broker’s app.

-

Place an Order with Your Broker – You can do this physically at the broker’s office or online through platforms like NSE App, Faida Online, or GenghisApp.

-

Specify the Type of Order –

- Market Order: Buys at the current market price.

- Limit Order: Buys only when the price reaches your preferred level.

-

Confirm Your Purchase – Once your broker executes the trade, you’ll receive a trade confirmation showing the number of shares purchased and the total cost.

-

Check Your CDS Account – Within a few days, the shares should appear in your CDS account, confirming your ownership.

7. How Much Does It Cost to Buy Safaricom Shares?

The total cost includes:

- Share Price – The price per share multiplied by the number of shares.

- Brokerage Fee – Usually around 1.5% of the total transaction amount.

- NSE and CMA Levies – Small fees charged by the Nairobi Securities Exchange and Capital Markets Authority.

For example, if Safaricom’s share price is KES 15 and you buy 1,000 shares, your total cost will be around KES 15,000 + transaction fees.

8. How to Track Your Safaricom Shares

You can monitor your investment through:

-

Your broker’s online portal or mobile app, which displays real-time share prices.

-

The Nairobi Securities Exchange website, which publishes daily price updates.

-

Annual financial reports from Safaricom PLC’s investor relations portal, where you can review dividend announcements and company performance.

Tracking your shares helps you know when to buy more or sell for profit.

9. How to Sell Safaricom Shares

Selling your shares is as simple as buying them. Simply:

-

Log in to your broker’s trading platform.

-

Place a sell order for the number of shares you wish to sell.

-

The broker executes the trade, and the sale proceeds are deposited into your account (less fees).

You can choose to sell when prices rise to make a profit or hold for long-term dividends.

10. Tips for First-Time Investors

- Start Small – Begin with a manageable amount and grow your portfolio over time.

- Diversify – Don’t invest all your money in one stock. Consider other blue-chip companies on the NSE.

- Stay Informed – Follow financial news and company updates.

- Think Long-Term – Safaricom shares may fluctuate in the short term but tend to appreciate over time.

11. Dividends and Returns

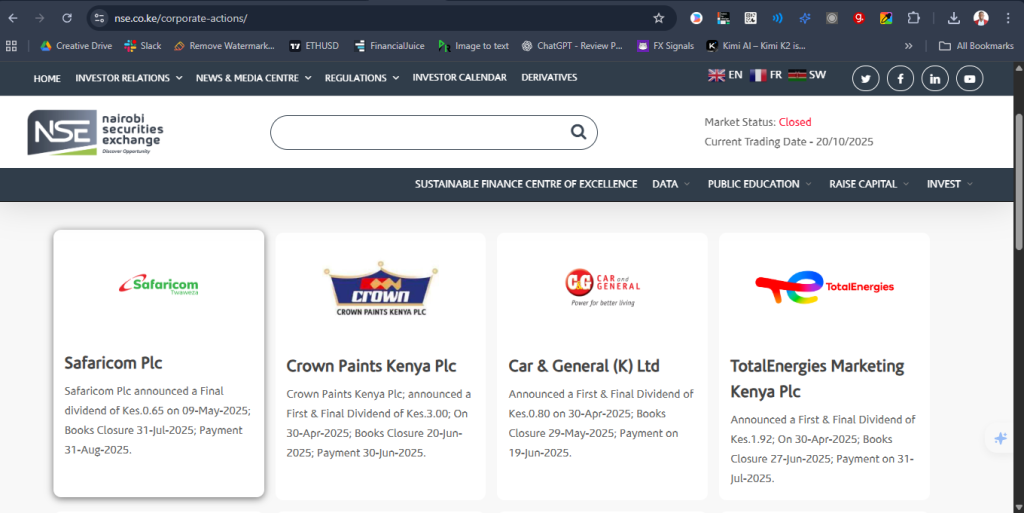

Safaricom is known for rewarding its shareholders through consistent dividend payments. Dividends are usually declared annually after financial results are released. They can be credited directly to your bank account or paid via M-PESA depending on your preferred option.

12. Risks to Consider

Every investment carries risk, and Safaricom shares are no exception. Key risks include:

- Market Volatility – Share prices fluctuate due to market forces.

- Regulatory Changes – New policies can affect profitability.

- Competition – Increased competition from telecom and fintech players.

Always perform due diligence or consult a licensed financial advisor before making large investments.

FAQs on How to Buy Safaricom Shares in Kenya

1. How much is 100 shares of Safaricom?

The price of 100 Safaricom shares depends on the current market price. For example, if the share price is KES 15, then 100 shares cost KES 1,500, excluding transaction fees. Always check the live price on the NSE website or your broker’s app.

2. How to buy Safaricom shares via M-PESA?

You can buy Safaricom shares via M-PESA by funding your broker account through their Paybill number, then placing a buy order through their online trading platform. Some brokers like Faida Investment Bank and Genghis Capital accept direct M-PESA payments for trading.

3. How to buy Safaricom shares online?

To buy Safaricom shares online:

-

Open a CDS account with an online broker.

-

Fund your account via M-PESA or bank transfer.

-

Log in to the broker’s trading app or portal.

-

Search for Safaricom (SCOM) and place a buy order.

This process is fast, secure, and paperless.

4. Benefits of buying Safaricom shares

The benefits include regular dividends, potential for long-term capital growth, easy liquidity, and ownership in one of Kenya’s most profitable companies.

5. Why is Safaricom share price dropping?

The share price may drop due to factors such as market corrections, investor sentiment, reduced earnings, regulatory changes, or economic uncertainty. However, temporary price drops can offer good buying opportunities for long-term investors.

6. How to check my Safaricom shares online?

You can check your Safaricom shares by:

-

Logging in to your broker’s online portal or mobile app,

-

Visiting the NSE website for live prices, or

-

Requesting a CDS statement from your broker or the Central Depository & Settlement Corporation (CDSC).

7. How to sell Safaricom shares?

To sell, log in to your trading account, place a sell order for your Safaricom shares, and confirm the transaction. The proceeds are sent to your bank account after settlement (usually within 2–3 days).

8. Safaricom shares selling price today

The Safaricom share selling price today fluctuates depending on market activity. You can find the latest selling price on the NSE website, through the NSE mobile app, or from your broker’s trading platform in real-time.

9. Can I buy Safaricom shares without a broker?

No, you need a licensed stockbroker or investment bank to facilitate trades on the NSE.

10. Can foreigners buy Safaricom shares?

Yes, foreign investors can buy Safaricom shares after opening a CDS account with a valid passport and required documentation.

Final Thoughts on How to Buy Safaricom Shares in Kenya

Buying Safaricom shares in Kenya is one of the most accessible and potentially rewarding investment opportunities available today. With just a few documents, a CDS account, and a broker, you can own a stake in one of Africa’s most successful companies.

Whether you’re investing for dividends, long-term growth, or portfolio diversification, Safaricom provides a solid foundation for your financial journey.

Start small, stay informed, and let your investment grow with Kenya’s most innovative company